A Year of Change: Navigating a Stabilising Real Estate Market

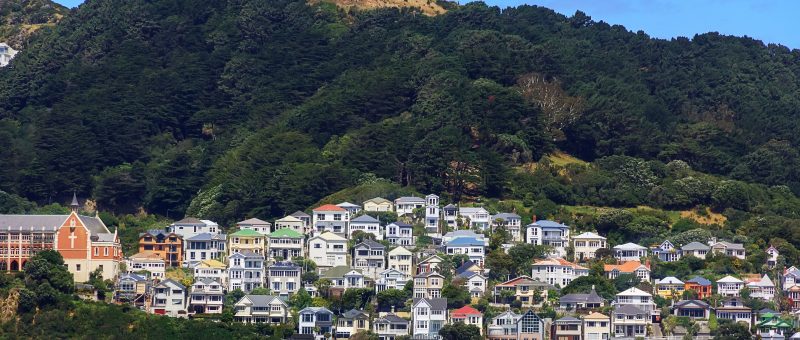

A year has passed since the real estate market shifted from a booming high to a more sombre low, and buyers and sellers can look forward to a more stable 12 months ahead. This is the perspective of Tommy’s Real Estate Sales Director, Nicki Cruickshank.

A year has passed since the real estate market shifted from a booming high to a more sombre low, and buyers and sellers can look forward to a more stable 12 months ahead. This is the perspective of Tommy’s Real Estate Sales Director, Nicki Cruickshank.

“One year on from the high, having had the largest gain and now the largest fall, we are facing a much more settled market,” she says.

“Sales numbers, for us anyway, are very similar this month and last month to the same time last year — it’s just the prices are quite a bit different.

“Houses are still selling, but buyers are certainly under no time pressure, so they are taking a lot longer to sell.”

Despite the dramatic downturn startling everyone from buyers and sellers to economists and pundits, Nicki says this wasn’t what shocked her the most. “I think the way the market rose over a year ago was the biggest surprise. “It was astonishing what some houses were selling for, so the fall was to be expected, and prices are a lot more realistic now.

“Wellington has probably had the largest correction to date, but the regions do generally follow and they may have a bit further to go.

“I’m expecting our market to remain pretty settled for the next few years as per our normal cycles.”

Nicki says the one variable that could stymie this would be more interest rate hikes. “If interest rates do continue to increase at current levels, it will put more pressure on the house market, and there will be fewer buyers coming into the market and demand will decrease. However, I would expect this to be fairly short term.”

She says so far the higher interest rates aren’t deterring most buyers. “There has been a bit of a pullback from buyers for those that don’t have to buy, but would like a change.

“So those sitting in their current house and would like to upsize or downsize are potentially holding off. “However, it is probably the most ‘affordable’ time to make that change when the difference between the two properties will never be less.”

Nicki doesn’t believe the pending general election will affect prices, either. “Leading up to an election, some people do hold off and await the result.

However, it mainly affects investors, and as there are virtually no investors in the market at the moment, it won’t make a lot of difference.”

But she is concerned about a rental stock crisis in the wake of investors quitting the market.

“I can see another looming rental shortage in Wellington City as students start to look for their accommodation for next year.

“A lot of the traditional student properties have been sold to owner-occupiers, and our property management arm is getting inundated with calls at the moment from those desperate for a property to rent.”

As for a recent CoreLogic report that showed hundreds of first-home buyers in Wellington are estimated to be in negative equity because of persistent price falls across the region, Nicki doubts this will have much of an impact on the market.

“So far we have not seen any sign of distressed sale of people being in negative equity,” she says.

“I am sure they are out there, but you buy a house for the long term, and it is just a matter of riding it out. “Most people will do everything they can to hold on to their house, and hopefully they all can.”

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal