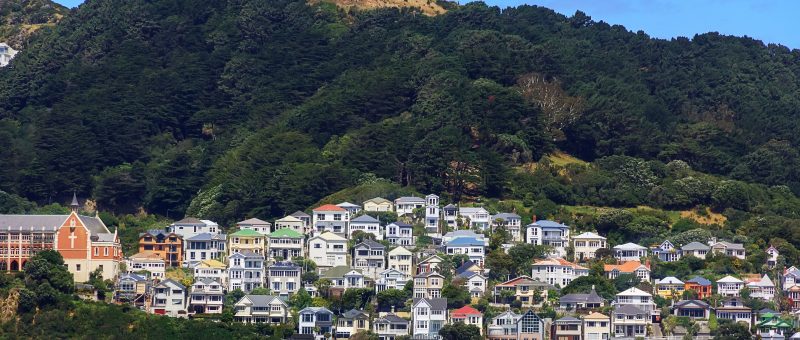

The waning popularity of buying off the plans means there are prime opportunities for first-time buyers and investors willing to speculate on townhouses and apartments, Tommy’s Real Estate Sales Director Nicki Cruickshank says.

“Buying off the plans has really fallen with the loss of investors and first-home buyers, the two main groups who have bought off the plans in recent years.

“The high cost of building has made the cost of buying off the plans too expensive for investments to ‘stack up’, particularly with interest rates doubled in the last year, and no signs of them stopping in the immediate future.

“First-home buyers were also a prime market for new townhouses and apartments, but with the very tough lending rules on these now, we have seen a huge fall-off in this market, along with the fact, many have probably given up and gone overseas.”

There also have been horror stories about developers who have used sunset clauses to void contracts and re-sell at higher prices, leaving the original buyer in the lurch. Nicki says some potential buyers may be scared off developments because of this but it’s not been an issue in Wellington. “It seems very much an Auckland problem. We have had none of our developers put up prices through delays, rising building costs and high holding costs.

“We are very lucky to have some great developers. Those we deal with are secure and steady. “They understand Wellington is a smaller market and want to ensure their reputations are kept intact long-term. “Tommy’s only deals with reputable and proven developers and stands by the products that we sell on their behalf.

“Deposits are never at risk as they are always held by the developer’s lawyer.”

Nonetheless, she recommends buyers always check the track record of developers. “And if they are still delivering and have had a 100 percent completion rate, you should be fine.

“There are some really good deals out there at the moment, and by the time the developments are built, we could be back into a much better market, so some great opportunities for those prepared to speculate.

“The advantages of purchasing off the plans at the moment is you are likely to get a reasonable deal and with hopefully the market evening out, and opportunity for it to steady and start to rise again, you will have a desirable product to sell or rent out.

“You can, of course, benefit from still being able to claim interest on loan if it is a new build and the timeframe to hold on to and not pay capital gains tax is a lot less than an existing house. “Your maintenance costs also are a lot lower on a new property.” Nicki estimates developments were driving about 20 percent of total sales. “But this has fallen off in the last few months to probably single figures.

“We need new housing in Wellington, so hopefully this will pick up again soon and everyone will have the confidence to get back into this market. “We have a couple of great opportunities left in smaller developments near Wellington Regional Hospital, in Newtown, which would be great renters for the hospital, Mount Victoria and the much sought after Lyall Bay.

“It does feel like there are a few more people out there looking at the moment, and there certainly is a bit more positivity in that first-home buyers market. “So let’s hope they can get into the market. Who knows — we may have reached the bottom.”

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal