Wellington Market Update | April 2024

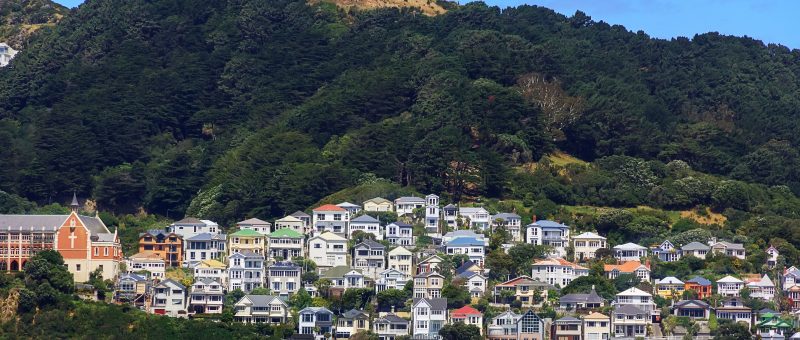

Wellington house prices are slowly ‘bouncing back’ despite a challenging economy, says Tim Clark, Sales Director at Tommy’s Real Estate

The latest QV House Price Index report indicates that Wellington ranked second only to Queenstown for house price growth in the first quarter of 2024.

“Of the main urban areas we monitor, Queenstown experienced the most growth this quarter at 2.7 percent, with Wellington and Christchurch not far behind on 2 percent and 1.5 percent respectively,” QV reports.

“Once again, Kapiti (5 percent) has recorded the largest average increase in home value, followed by Upper Hutt (3.8 percent). Home values also increased on average in Wellington City (1.9 percent), Porirua (0.7 percent), and Hutt City (0.4 percent), though at a slower rate than the national average (2.2 percent).”

“At Tommy’s, we are seeing property prices bouncing back, albeit at a slower pace,” Tim observes.

“There are many multi-offer situations happening, which makes those sales competitive and therefore maximises the price that the current market is willing to pay. It is also important to note that Wellington had the largest price correction from the heights of late 2021.”

Tim echoes the sentiments of other commentators, noting that housing market confidence has improved over the last six to nine months. However, both buyers and sellers face key challenges, including high-interest rates, tighter credit conditions, and an influx of listings that reduces competition for houses amidst a technical recession.

“There are some tough economic headwinds ahead for New Zealand for sure,” Tim says. “The much-talked-about factors such as housing affordability, public service cuts, higher interest rates, and tougher lending rules will impact the local market. However, there will be a difference between the perceived impacts and real impacts. The market will continue to transact as it always does, but there will be pockets of difficult times for some people.

“Overall, at Tommy’s, we remain optimistic about the future and feel we have returned to a more normal market, which is a good thing overall, especially when the last five or so years have not been normal.”

Tim highlights that first-home buyers remain the largest pool of buyers. “However, we are seeing a slow and gradual return of investors as well.”

This follows the Government’s reintroduction of mortgage interest deductibility for investors and the reduction of the bright-line test from ten years to two. From 1 July, only investors who sell a rental property within two years of buying it will have to pay tax on any gains received.

“The current market, whilst being a more normal market, does favour buyers a little more,” Tim notes. “So, it is imperative for sellers to present, promote, and price their properties properly to achieve a successful sale. Of course, a major factor in a successful sale is also engaging the best real estate agent.”

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal